Hong Kong

(HK Electric)

Macau

New York

Sydney

London

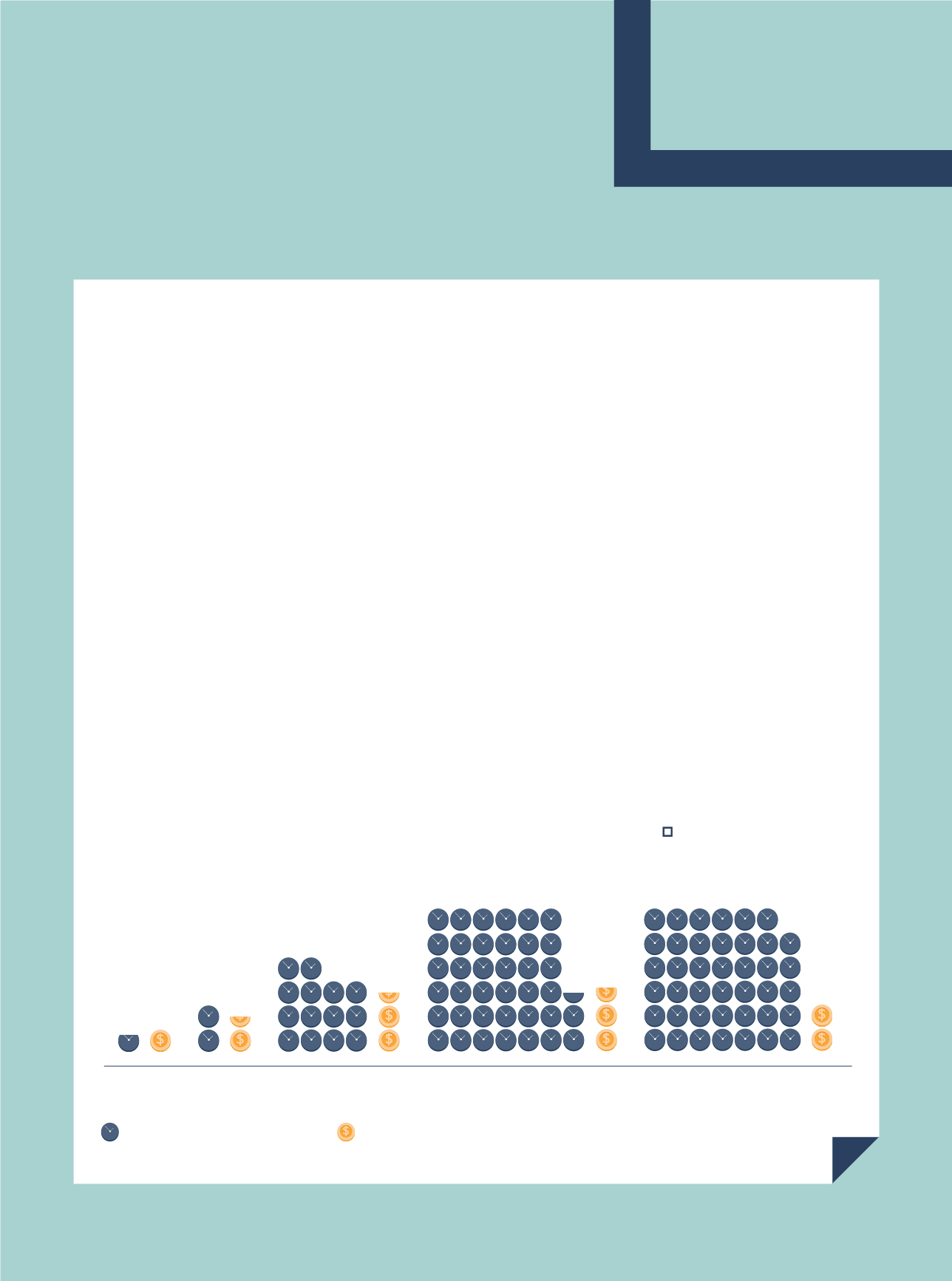

Average yearly outage (minute)

Tariff comparison per kWh (HKD)

*Excluding outage due to stoppage and power supply limits by the Mainland

Sphere

#35

2014

21

Like many countries around the

world, Hong Kong is considering

what fuel mix meets its energy needs

and community aspirations. Price,

reliability, air quality, autonomy,

carbon footprint and much more

bear on the complex considerations

involved in committing countries,

provinces, states and cities to long-

term fuel solutions.

The Hong Kong government is

consulting public opinion. InMay,

Mr Canning Fok, Chairman of Power

Assets, made his views known.

Choices

Members of the public have been

presented with two options:

Option 1: Purchase 30 per cent

electricity fromneighbouring China

Southern Power Grid (CSG); or

Option2:Generate60percentelectricity

fromnatural gas in Hong Kong.

At the Power Assets shareholder

meeting, Mr Fok presented a case for

strongly supporting Option 2. Hong

Kong’s biggest concerns — reliability,

price and air quality — formed the

centrepiece of his logic.

Reliability

The quality of electricity supply inHong

Kong trumps the world with reliability at

over 99.999 per cent . Hongkong Electric

(HKElectric) customers in particular

experience less than oneminute of

outage each year. At first glance, some

may not think that CSG’s 99.96 per cent

reliability is that much of a difference,

but those few decimal points translate to

3.2 hours a year, or 16minutes amonth!

If even a recent eight-minute breakdown

of the local metro caused chaos

throughout the city, it’s not too difficult

for one to imagine how disastrous 16

minutes would be to a city of soaring

high-rises and a financial centre. Not

only would the banks and stock exchange

be affected, lifts, water pumps and even

emergency services would be severely

crippled. Option 1 would be a big step

backwards for Hong Kong.

Price

HK Electric customers currently

pay about HKD1 per kWh. This

compares favourably to HKD1.31 per

kWh inMacau, which purchases over 90

per cent of its electricity fromCSG, and

to other major cities worldwide. If Hong

Kong was to connect to CSG’s network,

it would require HKD20-30 billion of

new infrastructure which translates

to HKD0.30 per kWh. Add that to the

wholesale price of HKD0.80 per kWh

that Macau pays and Hong Kong’s own

network costs, buying electricity across

the border would undoubtedly be more

expensive than local generation.

Air quality

The electricity supplied to CSG’s

Guangdong grid is primarily generated

from coal, so more coal will have to be

burnt to meet new demand fromHong

Kong. While some may think out of

sight, out of mind, monsoon winds put

paid to that notion. The winter winds

regularly blow polluted air south to

Hong Kong. Not only would Hong

Kong’s cousins to the north suffer from

coal burning, the air would eventually

blow south to Hong Kong and the

rest of the Pearl River Delta. Cleaner

burning gas would benefit people in

Hong Kong and China alike and help

China’s efforts to reduce its overall

carbon footprint.

Mr Fok’s strong views come from

decades of experience of working in the

power sector and a great love of Hong

Kong, HK Electric’s headquarters. The

call to duty to make his views known

has been answered in convincing

fashion.

Hong Kong’s future energy options pit

clean vs coal, certain vs questionable.

Mr Canning Fok makes the case for

local generation.

VIEWS

Energy[Policy

HK Leads on price and stability

0.7

2.1*

14.1

38.5

41.0

$1.00

$2.30

$2.61

$2.04

$1.31